Banks have brought in almost $1 trillion in revenues considering that the monetary crisis, but they paid a high cost in the process.

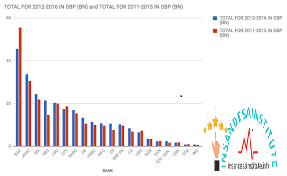

In total, banks have actually paid $321 billion in fines associated with the crisis, according to a research study launched today by the Boston Consulting Group. U.S. banks have taken on a lot of those costs, though international establishments likewise have actually been hit.

The launch comes the very same week the FDIC reported that financial institution earnings surged to a record $171.3 billion in 2016, enhanced by a best-ever $45.6 billion in the 3rd quarter. The year’s earnings brought the complete post-crisis web (gauged from the third quarter of 2009) to $987.8 billion, according to FDIC records.

Nevertheless, the research study keeps in mind that financial institutions have paid greatly for the issues they developed and encounter a hard landscape in advance.

” Taking care of these prices is a major burden for financial institutions, needing the creation of a strong non-financial-risk framework to stay clear of errors of the past,” the Boston Consulting writers said.

Amongst the greatest obstacles to growth is a collection of laws that has balanced 200 modifications a day since 2011, the year Congress embraced the Dodd-Frank reforms. The legislation looked for to lower the possibility that organizations could come to be as well huge to fail and also need the expensive bailouts necessitated during the situation.

Boston Consulting stated a major obstacle waits for in identifying just exactly how those big establishments will be unwound ought to they present systemic danger.

” About various other areas of reform, resolution stays the least established as well as the majority of pressing,” the report claimed. “There is still no consensus on just how to close down (or take a break) financial institutions or on which preparatory, architectural procedures may be required.”

The report kept in mind that financial reforms will certainly continue, in spite of the basic anti-regulatory climate coming from the brand-new U.S. presidential administration.

‘ Enhanced guideline is below to remain’

While Head Of State Donald Trump has been critical of Dodd-Frank, he likewise has lashed out at huge financial institutions as well. The general political agreement is that the White House will certainly search for means to relieve problems for neighborhood as well as regional banks while largely keeping the stress on larger institutions. The lone exemption to that may be removal of the so-called Volcker Guideline, which prohibits financial institutions from trading for their own accounts.

” Boosting law is here to remain– similar to a long-term increase in water level instead of an incoming tide that will drop,” Boston Consulting said. “We expect this theme to hold despite recent political growths in the U.S. that might augur vital obstacles to regulatory implementation.”

The record asks for financial institutions to function extra carefully with regulatory authorities to establish policies that make sense, as well as to focus on executing technological modifications to minimize costs and enhance performance.