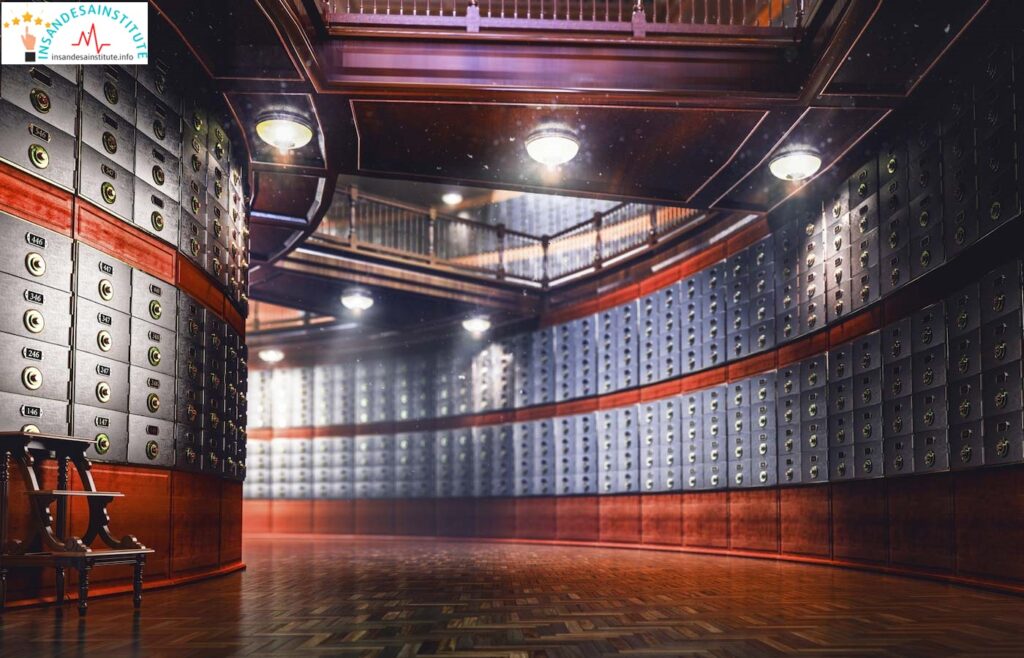

It’s a digital world, no doubt. Almost anything that matters is saved essentially in the cloud. Therefore, a physical risk-free deposit box might feel like a relic of the bricks-and-mortar (and also high-strength steel) past. Yet don’t cross out the value of maintaining specific valuables securely hid in your bank’s vault (That is, if your existing bank has a secure deposit box vault; several are being gotten rid of.).

Some instances of things you can as well as must keep in a safe deposit box include treasured properties such as baseball cards or fashion jewelry inherited from a family member, for instance. A safe deposit box can likewise use vital security for essential records.

But a safe deposit box isn’t a wise option for several things. There are products you may come to regret locking away in your financial institution, which isn’t open evenings, vacations or maybe even weekend breaks.

Access to your risk-free deposit box could be even more limited during emergency situations, including natural disasters (which could even threaten the financial institution and box itself, depending on where you live). The coronavirus pandemic, also, minimized running hrs for some bank branches, and restricted accessibility or needed appointments for in-branch solutions, such as accessibility to risk-free deposit boxes. Steps like that complicate your ability to fetch vital files or things when you require them– the response is to produce an economic plan for all-natural disaster beforehand.

Experts suggest saving crucial products that you require to access extra often or on short notice in a fire resistant home safe that’s bolted to the flooring. But what are those things? Continue reading for our listing of safe deposit box no-no’s.